UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box:

|

|

|

|

|

|

|

|

|

|

Conatus Pharmaceuticals☐ Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

Histogen Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☒ No fee required. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

16745 West Bernardo Drive, Suite 200

San Diego, CA 92127

NOTICE OF ANNUALSPECIAL MEETING OF STOCKHOLDERS

STOCKHOLDERS AND PROXY STATEMENT

Dear stockholder:Stockholder:

The annualNotice is hereby given that a special meeting of stockholders (the “Special Meeting”) of Conatus PharmaceuticalsHistogen Inc., a Delaware corporation (the “Company”), will be held on Tuesday, December 5, 2023 at the offices of Latham & Watkins LLP, located at 12670 High Bluff Drive, San Diego, CA 92130, on June 23, 2016 at 9:8:00 a.m., local time,Pacific Time via a live webcast, for the following purposes:

|

|

2. To approve the adjournment from time to time of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes to approve the Plan of Dissolution (the “Adjournment Proposal”). After careful consideration of a number of factors, as described in the attached proxy statement, the Board of Directors of the Company (the “Board”) has unanimously determined that the Plan of Dissolution is advisable and in the best interests of the Company and its stockholders. The Board unanimously recommends that you vote (i) “FOR” the Dissolution Proposal; and (ii) “FOR” the Adjournment Proposal. As noted above, the Special Meeting will be completely virtual, and will be conducted solely by remote communication via a live webcast. There will not be a physical meeting location and stockholders will not be able to attend the Special Meeting in person. This means that you can vote your shares and attend the Special Meeting online via the live webcast. To be admitted to the live webcast, you must enter the control number included in your proxy materials at www.virtualshareholdermeeting.com/HSTO2023SM. Further instructions on how to attend and participate online are available at www.virtualshareholdermeeting.com/HSTO2023SM and on the proxy card. You will not be able to attend the Special Meeting in person. |

|

|

|

|

The foregoing items of business are more fully described in the attached proxy statement, which forms a part of this notice and is incorporated herein by reference. Our board of directorsBoard has fixed the close of business on April 25, 2016October 16, 2023 as the record dateRecord Date for the determination of stockholders entitled to notice of and to vote at the annual meetingSpecial Meeting or any adjournment or postponement thereof.

Accompanying this noticeYour vote is a proxy card.important. Whether or not you expect to attend our annual meeting, please complete, sign and dateSpecial Meeting, we encourage you to read the enclosed proxy card and return it promptly, or completestatement accompanying this notice and submit your proxy via phone or the internet in accordance withvoting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions providedin the section entitled “General Information About the Special Meeting and Voting” beginning on page 1 of the enclosed proxy card.statement accompanying this notice. If you plan to attend our annual meetingSpecial Meeting virtually via the live webcast and wish to vote your shares personally,at the virtual meeting, you may do so at any time before the proxy is voted.

All stockholders are cordially invited to attend the meeting.meeting virtually.

By Order of the Board of Directors, | ||

|

| |

| ||

| ||

|

San Diego, California

April 28, 2016

Your vote is important. Please vote your shares whether or not you plan to attend the meeting.

|

|

|

| President, Chief Executive Officer, Chief Financial Officer and Secretary | |

San Diego, California October 18, 2023 |

TABLE OF CONTENTS

i

16745 West Bernardo Drive, Suite 200San Diego, CA 92127

PROXY STATEMENT

FOR THE 2016 ANNUALSPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON THURSDAY, JUNE 23, 2016TUESDAY, DECEMBER 5, 2023

The boardBoard of directorsDirectors (sometimes referred to as the “Board”) of Conatus PharmaceuticalsHistogen Inc. (sometimes referred to as “we,” “us,” “our,” the “Company” or “Histogen”) is soliciting the enclosed proxy for use at the annuala special meeting of stockholders to be held(including any adjournments, continuations or postponements thereof, the “Special Meeting”) on Tuesday, December 5, 2023 at the offices of Latham & Watkins LLP, located at 12670 High Bluff Drive, San Diego, CA 92130, on June 23, 2016 at 9:8:00 a.m., local time. If you need directions to the location of the annualPacific Time. The Special Meeting will be a virtual meeting, please contact us at (858) 376-2600.which will be conducted via live webcast.

Important Notice Regarding the Availability of Proxy Materials for the Annual

Special Meeting of Stockholders to be Heldheld on June 23, 2016.Tuesday, December 5, 2023.

This proxy statement and our Annual Report on Form 10-Kthe form of proxy card for the Special Meeting (this “Proxy Statement”) are available electronically at www.proxydocs.com/cnat.www.virtualshareholdermeeting.com/HSTO2023SM.

GENERAL INFORMATION ABOUT THE ANNUALSPECIAL MEETING AND VOTING

Questions and Answers Regarding the Special Meeting

Why did you send me this proxy statement?

Our Special Meeting proxy materials are accessible at: www.virtualshareholdermeeting.com/HSTO2023SM.

We sent you this proxy statement and the enclosed proxy card because our board of directorsBoard is soliciting your proxy to vote at the 2016 annual meetingSpecial Meeting of stockholders.Stockholders. This proxy statement summarizes information related to your vote at the annual meeting.Special Meeting. All stockholders who find it convenient to do so are cordially invited to attend the annual meeting in person.Special Meeting virtually. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or complete and submit your proxy via phone or the internet in accordance with the instructions provided on the enclosed proxy card.

How can I attend the Special Meeting?

The Special Meeting will be accessible through the Internet via a live webcast. We intendadopted a virtual format for our Special Meeting to begin mailing this proxy statement,enhance stockholder access, participation and communication by allowing our stockholders to join remotely from anywhere with an Internet connection, and avoid the attached noticetime, effort and elevated expenses of annual meeting andorganizing physical meetings which historically have been attended by only a few stockholders.

Who can vote at the enclosed proxy card on or about May 6, 2016 to allSpecial Meeting?

Only stockholders of record entitled to vote at the annual meeting. Only stockholders who owned our common stockclose of business on April 25, 2016October 16, 2023, the record date for the Special Meeting (the “Record Date”), are entitled to vote at the annual meeting. On this record date,Special Meeting.

At the close of business on the Record Date, there were 21,247,1584,271,759 shares of our common stock outstanding. Common stock is ourthe only class of stock entitled to vote.vote at the Special Meeting. A list of our stockholders of record will be available for inspection online during the Special Meeting at www.virtualshareholdermeeting.com/HSTO2023SM, and during the ten days prior to the Special Meeting upon request.

If you would like to view the list, please contact our Secretary to schedule an appointment by calling (302) 636-5401 or writing to her directed to the Company’s agent for service of process at Corporation Service Company, 251

Little Falls Drive, Wilmington, New Castle County, Delaware 19808, or to the email address set forth in the Company’s proxy materials and/or identified on the Company’s investor relations website. The Company terminated its lease agreement for its headquarters and laboratory. Accordingly, the Company does not maintain a headquarters. For purposes of compliance with applicable requirements of the Securities Act of 1933, as amended, and Securities Exchange Act of 1934, as amended, any stockholder communication required to be sent to the Company’s principal executive offices may be directed to the Company’s agent for service of process as stated above.

Stockholders of Record: Shares Registered in Your Name

If, on the Record Date, your shares were registered directly in your name with the transfer agent for our common stock, Equiniti Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may vote at the Special Meeting if you attend online or vote by proxy. Whether or not you plan to attend the Special Meeting online, we encourage you to vote by proxy via the Internet, by telephone or by mail, as instructed below to ensure your vote is counted.

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If, on the Record Date, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Special Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. Since a beneficial owner is not the stockholder of record, you may not vote your shares in person at the Special Meeting unless you obtain a “legal proxy” from the broker, bank, trustee or nominee that holds your shares giving you the right to vote the shares at the meeting. If you are a beneficial owner and do not wish to vote in person or you will not be attending the Special Meeting, you may vote by following the instructions provided by your broker, bank, trustee, or other nominee.

What am I voting on?

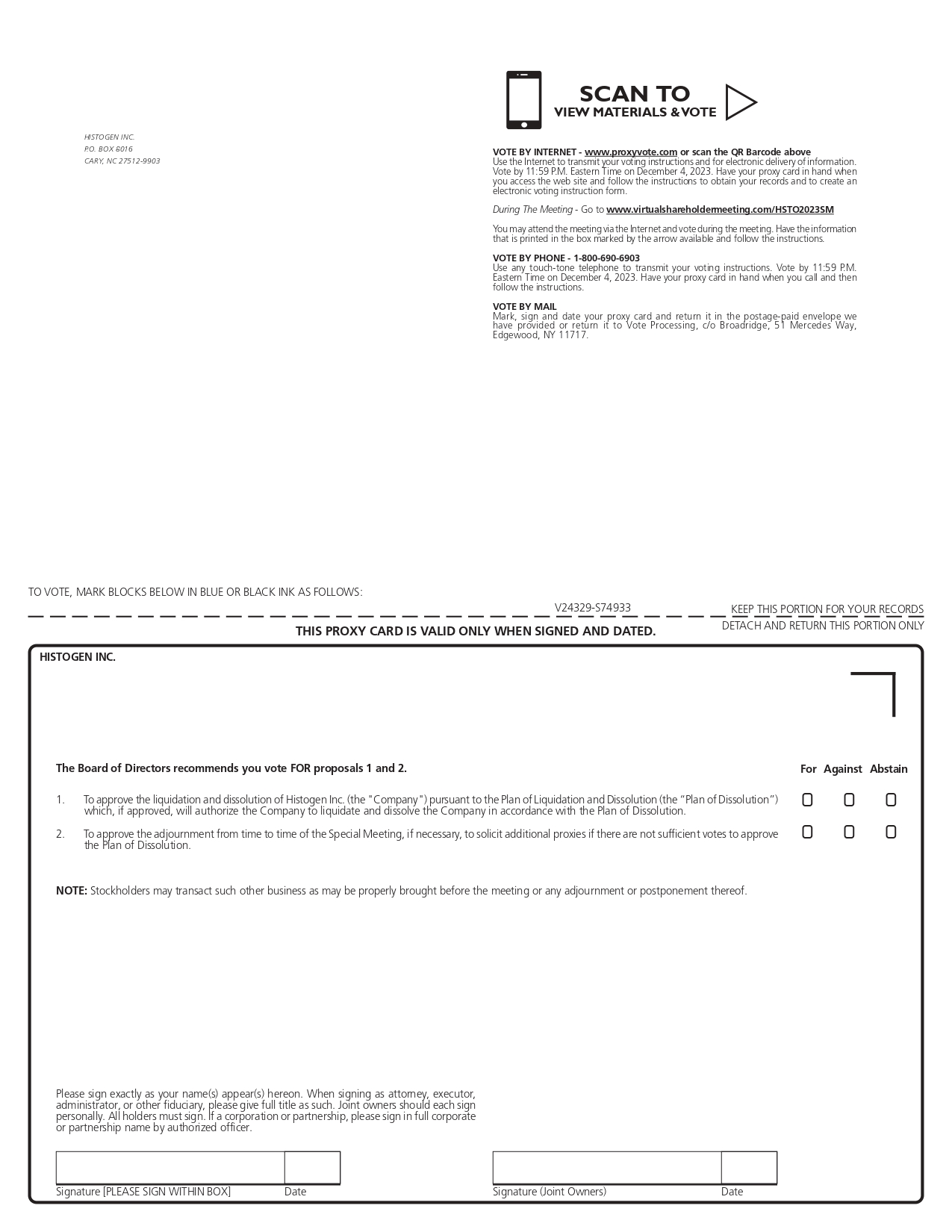

There are two proposals scheduled for a vote:

|

| |

|

|

How many votes do I have?

Each share of ourHistogen common stock that you own as of April 25, 2016October 16, 2023, the Record Date, entitles you to one vote.vote at the Special Meeting.

How do I vote by proxy?vote?

With respect to the election of directors, you may either vote “For” alleach of the nominees toDissolution Proposal (Proposal 1) and the board of directors or you may “Withhold” your vote for any nominee you specify. With respect to the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm,Adjournment Proposal (Proposal 2), you may vote “For” or “Against”“FOR,” “AGAINST” or abstain from voting.

Stockholders of Record: Shares Registered in Your Name

If you are a stockholder of record, there are several ways for you to vote your shares. Whether or not you plan to attend the meeting,virtual Special Meeting, we urge you to vote by proxy prior to the Special Meeting to ensure that your vote is counted.

• Via the Internet: If you are a stockholder of record, you may vote at www.proxyvote.com, 24 hours a day, seven days a week by following the Internet voting instructions on your proxy card. • By Telephone: If you are a stockholder of record, you may vote using a touch-tone telephone by calling 1-800-690-6903, 24 hours a day, seven days a week by following the telephone voting instructions on your proxy card. • By Mail, if You Requested a Printed Copy of Your Proxy Materials: You may vote using your proxy card by completing, signing, dating and returning the proxy card in the self-addressed, postage-paid envelope provided. If you properly complete your proxy card and send it to us in time to vote, your proxy (one of the individuals named on your proxy card) will vote your shares as you have directed. If you sign the proxy card but do not make specific choices, your shares, as permitted, will be voted as recommended by our Board. If any other matter is presented at the Special Meeting, your proxy will vote in accordance with his or her best judgment. As of the date of this proxy statement, we knew of no matters that needed to be acted on at the meeting, other than those discussed in this proxy statement. • At the Virtual Special Meeting: The Special Meeting will be conducted solely online via live webcast. You will be able to attend and participate in the Special Meeting online and vote your shares electronically during the meeting by visiting www.virtualshareholdermeeting.com/HSTO2023SM on Tuesday, December 5, 2023, at 8:00 a.m., Pacific Time. To be admitted to the Special Meeting you will need to enter the control number included in your proxy materials at www.virtualshareholdermeeting.com/HSTO2023SM. There is no physical location for the Special Meeting. We recommend you log in at least 15 minutes before the meeting to ensure you are logged in when the meeting starts. Further instructions on how to attend and participate online are available at www.virtualshareholdermeeting.com/HSTO2023SM and on the proxy card.

|

|

|

|

|

|

|

|

Beneficial Owners: Shares Registered in the Name of a Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, and requested a printed copy of the proxy materials, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than directly from us. Simply complete and mail the proxy card to ensure that your vote is counted. You may be eligible to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms offer Internet and telephone voting. If your bank or brokerage firm does not offer Internet or telephone voting information, please complete and return your proxy card in the self-addressed, postage-paid envelope provided. To vote in person atduring the annual meeting,live webcast of the Special Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials or contact your broker or bank to request a proxy form.

May I revoke my proxy?

If you give us your proxy, you may revoke it at any time before it is exercised. You may revoke your proxy in any one of the three following ways:

|

|

|

|

|

|

What constitutes a quorum?

The presence at the annual meeting, in personSpecial Meeting, by virtual attendance or by proxy, of holders representing a majorityone-third (1/3) of our outstanding common stock as of April 25, 2016,October 16, 2023, or approximately 10,623,5801,423,920 shares, constitutes a quorum at the meeting, permitting us to conduct our business.

What vote is required to approve each proposal?

Proposal 1: Election1 (Dissolution Proposal): Approval of Directors. The three nominees who receive the most “For”Plan of Dissolution requires the affirmative vote of a majority of all of the outstanding shares of our common stock as of the Record Date. Abstentions and broker non-votes (in other words, where a brokerage firm has not received voting instructions from the beneficial owner and for which the brokerage firm does not have discretionary power to vote on a particular matter) are counted as present and entitled to vote for purposes of determining a quorum. However, abstentions are not deemed to be votes (amongcast and, therefore, will have the same effect as votes “AGAINST” the Dissolution Proposal. Shares of our common stock represented by properly cast in person or by proxy)executed, timely received and unrevoked proxies will be elected. Only votes “For” or “Withheld” will affectvoted in accordance with the outcome.instructions indicated thereon.

Proposal 2: Ratification of Independent Registered Public Accounting Firm.2 (Adjournment Proposal): The ratificationApproval of the appointment of Ernst & Young LLP must receive “For” votes fromAdjournment Proposal requires the holdersaffirmative vote of a majority of the shares of our common stock presentcast at the Special Meeting (whether or not a quorum is present). Failure to vote virtually or by proxy at the Special Meeting, abstentions and broker non-votes (if any) will have no effect on the outcome of the Adjournment Proposal. Shares of our common stock represented by proxyproperly executed, timely received and entitled to vote atunrevoked proxies will be voted in accordance with the annual meeting.instructions indicated thereon.

Voting results will be tabulated and certified by the inspector of election appointed for the annual meeting.Special Meeting.

How will my shares be voted if I do not specify how they should be voted?

If you are a stockholder of record and you indicate when voting on the Internet or by telephone that you wish to vote as recommended by the Board, then your shares will be voted at the Special Meeting in accordance with the Board’s recommendation on all matters presented for a vote at the Special Meeting. Similarly, if you sign and return a proxy card but do not indicate how you want to vote your shares for a particular proposal or for any of the proposals, then for any proposal for which you do not so indicate, your shares will be voted in accordance with the Board’s recommendation.

If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, then, the organization that holds your shares may generally vote your shares in their discretion on “routine” matters, but may not use its discretion to vote your shares on “non-routine” matters under the rules of the New York Stock Exchange (the “NYSE”). If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, that organization will inform the inspector of election that it does not have the authority to vote on that matter with respect to your shares. This is generally referred to as a “broker non-vote.” Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. We believe that the Dissolution Proposal is a “non-routine” matter and so, without instruction from the beneficial owner of shares held in street name, the organization that holds the shares will not be able to vote on Proposal 1.

What is the effect of abstentions and broker non-votes?

Shares of common stock held by persons attending the annual meetingvirtual Special Meeting but not voting, and shares represented by proxies that reflect abstentions as to a particular proposal, will be counted as present for purposes of determining the presence of a quorum. Abstentions are treated as shares present in personnot an affirmative or by proxy and entitled tonegative vote on a proposal, so abstaining does not count as a vote cast and has no effect for purposes of approval of the Adjournment Proposal. Approval of the

Dissolution Proposal is determined by the affirmative vote of a majority of all of the outstanding shares of our common stock as of the Record Date, so abstentions will have the same effect as a negative vote for purposes of determining whether our stockholders have ratifiedvotes “AGAINST” the appointment of Ernst & Young LLP, our independent registered public accounting firm. However, because the election of directors is determined by a plurality of votes cast, abstentions will not be counted in determining the outcome of such proposal.Dissolution Proposal.

Shares represented by proxies that reflect a “broker non-vote”broker non-vote will be counted as present for purposes of determining whetherthe presence of a quorum exists. A “broker non-vote”As discussed above, a broker non-vote occurs when a nomineean organization holding shares for a beneficial owner has not received instructions from the beneficial owner and does not have discretionary authority to vote the shares for certain non-routine matters. With regard to the election of directors, broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote. However, ratification of the appointment of Ernst & Young LLPThe Adjournment Proposal is considered a routine matter on which a broker or other nominee has discretionary authority to vote. Accordingly, noIf there are broker non-votes, they will likely resulthave the same effect as votes “AGAINST” the Dissolution Proposal.

How does the Board recommend that I vote?

The Board recommends that you vote:

Proposal 1 (Dissolution Proposal): “FOR” the approval of the Dissolution pursuant to the Plan of Dissolution.

Proposal 2 (Adjournment Proposal): “FOR” the approval of the adjournment from time to time of the Special Meeting, if necessary, to solicit additional proxies if there are not sufficient votes to approve the Plan of Dissolution.

If you vote via the Internet, by telephone, or sign and return a proxy card by mail but do not make specific choices, your shares, as permitted, will be voted as recommended by our Board. If any other matter is presented at the Special Meeting, your proxy will vote in accordance with his or her best judgment. As of the date of this proposal.Proxy Statement, we know of no matters that needed to be acted on at the Special Meeting, other than those discussed in this Proxy Statement.

Who is paying the costs of soliciting these proxies?

We will pay all of the costs of soliciting these proxies. Our directors, officersThe Company has engaged a proxy solicitation firm, Kingsdale Shareholder Services, U.S. LLC, 745 Fifth Avenue, Fifth Floor, New York, New York, 10151, and other employees may solicit proxies in personconduct further solicitation personally, by telephone or by mail, telephone, fax or email. Wefacsimile with the assistances of our officers, directors, and regular employees, none of whom will pay our directors, officers and other employees noreceive additional compensation for theseassisting with the solicitation. The Company has agreed to pay Kingsdale Advisors a non-refundable fee of $12,500 for its services. We have also agreed to reimburse Kingsdale Advisors for its reasonable out-of-pocket costs associated with solicitation of proxies, plus an additional performance fee payable in the event Proposal 1 is approved by our stockholders. We will also ask banks, brokers and other institutions, nominees, and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses. Our costs for forwarding proxy materials will not be significant.

How doWhom may I contact if I have other questions about the Special Meeting or voting?

Shareholders of Histogen who have questions or require assistance with voting their shares may contact Histogen’s strategic shareholder advisor and proxy solicitation agent: Kingsdale Advisors, by telephone at 1-888-212-9553 (North American Toll Free) or 1-646-741-7961 (Outside North America), or by email at: contactus@kingsdaleadvisors.com. To obtain an Annual Report on Form 10-K?

If you would like a copy of our Annual Report on Form 10-K for the year ended December 31, 2015 that we filed with the SEC, we will send you one without charge. Please write to:

Conatus Pharmaceuticals Inc.

16745 West Bernardo Drive, Suite 200

San Diego, CA 92127

Attn: Corporate Secretary

All of our SEC filings are also available free of charge in the “Investors—Financials & Filings” section of our website at www.conatuspharma.com.information about voting your Histogen shares, please visit www.histogenvote.com.

How can I find out the results of the voting at the annual meeting?Special Meeting?

Preliminary voting results will be announced at the annual meeting. FinalSpecial Meeting. We will publish the final voting results will be published in our current reporta Current Report on Form 8-K to be filed with the SEC within four business days after the annual meeting.Special Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting,Special Meeting, we intend towill file a Form 8-K to publish the preliminary voting results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

ELECTION OF DIRECTORS

Our board of directors is divided into three classes, with one class of our directors standing for election each year, generally for a three-year term. Directors for each class are elected at the annual meeting of stockholders held in the year in which the term for their class expires and hold office until their resignation or removal or their successors are duly elected and qualified. In accordance with our amended and restated certificate of incorporation and amended and restated bylaws, our board of directors may fill existing vacancies on the board of directors by appointment.

The term of office of our Class III directors, David F. Hale, Steven J. Mento, Ph.D., and Harold Van Wart, Ph.D., will expire at the 2016 annual meeting. The nominees for Class III directors for election at the 2016 annual meeting are David F. Hale, Steven J. Mento, Ph.D., and Harold Van Wart, Ph.D. If Mr. Hale, Dr. Mento or Dr. Van Wart is elected at the 2016 annual meeting, such individual will be elected to serve for a three-year term that will expire at our 2019 annual meeting of stockholders and until such individual’s successor is elected and qualified.

If no contrary indication is made, proxies in the accompanying form are to be voted for Mr. Hale, Dr. Mento and Dr. Van Wart or in the event that Mr. Hale, Dr. Mento or Dr. Van Wart is not a candidate or is unable to serve as a director at the time of the election (which is not currently expected), for any nominee who is designated by our board of directors to fill the vacancy.

All of our directors bring to the board of directors significant leadership experience derived from their professional experience and service as executives or board members of other corporations and/or venture capital firms. The process undertaken by the nominating and corporate governance committee in recommending qualified director candidates is described below under “Director Nomination Process.” Certain individual qualifications and skills of our directors that contribute to the board of directors’ effectiveness as a whole are described in the following paragraphs.

Information Regarding Directors

The information set forth below as to the directors and nominees for director has been furnished to us by the directors and nominees for director:

Nominees for Election to the Board of Directors

For a Three-Year Term Expiring at the2019 Annual Meeting of Stockholders (Class III)

|

|

| ||

|

|

| ||

|

|

| ||

|

|

|

David F. Hale has served as a member of our board of directors since October 2006 and chairman of the board since December 2012. Since May 2006, Mr. Hale has served as Chairman & CEO of Hale BioPharma Ventures, a private company focused on the formation and development of biotechnology, specialty pharma, device and diagnostic companies. He was previously President and CEO of CancerVax Corporation which merged with Micromet, Inc., a cancer therapeutic company, from October 2000 through May 2006, when he became Chairman of the combined companies until the sale of the company to Amgen Inc. Mr. Hale is a serial entrepreneur who has been involved in the founding and/or development of a number of biotechnology and specialty pharmaceutical companies. After joining Hybritech, Inc., in 1982, the first monoclonal antibody company, he was President & Chief Operating Officer and became CEO in 1986, when Hybritech was acquired by Eli Lilly and Co. From 1987 to 1997 he was Chairman, President and CEO of Gensia, Inc., which merged with SICOR to become Gensia Sicor, Inc., which was acquired by Teva Pharmaceuticals. He was a co-founder and Chairman of Viagene, Inc. from 1987 to 1995, when Viagene was acquired by Chiron, Inc. He was President and CEO of Women First HealthCare, Inc. from late 1997 to June 2000. Prior to joining Hybritech, Mr. Hale was Vice President and General Manager of BBL Microbiology Systems, a division of Becton, Dickinson & Co. and from 1971 to 1980, held various marketing and sales management positions with Ortho Pharmaceutical Corporation, a division of Johnson & Johnson, Inc. Mr. Hale also serves as Chairman of Biocept, Inc. Mr. Hale previously served as Chairman of Santarus, Inc., until its acquisition by Salix, Inc. in January 2014, as Chairman of Somaxon, Inc., until its acquisition by Pernix, Inc. in 2013 and as Chairman of SkinMedica, Inc., until its

acquisition by Allergan in 2012. He also serves as Chairman of a number of privately held companies, including Colorescience, Inc., Neurelis, Inc., MDRejuvena Inc., Recros Medica, Inc., Skylit Medical, Agility Clinical, Inc. and Adigica Health, Inc. Mr. Hale also is a co-founder and serves on the Board of Directors of BIOCOM, is a former member of the Board of the Biotechnology Industry Organization, or BIO, and the Biotechnology Institute. Mr. Hale also serves on the Board of Directors of the San Diego Economic Development Corporation, and as a Board Trustee of Rady Children’s Hospital of San Diego and as Chairman of the Board of Rady Children’s Institute of Pediatric Genomics. He is a co-founder of the CONNECT Program in Technology and Entrepreneurship. Mr. Hale holds a B.A. in Biology and Chemistry from Jacksonville State University. We believe Mr. Hale is qualified to serve on our board of directors because of his extensive knowledge of our business and history, experience as a board member of multiple publicly-traded and privately-held companies, and expertise in developing, financing and providing strong executive leadership to numerous biopharmaceutical companies.

Steven J. Mento, Ph.D. is one of our co-founders and has served as our President and Chief Executive Officer and as a member of our board of directors since July 2005. From July 2005 until December 2012, Dr. Mento also served as chairman of our board of directors. Dr. Mento has over 30 years of combined experience in the biotechnology and pharmaceutical industries. From 1997 to 2005, Dr. Mento was President, Chief Executive Officer and a member of the Board of Directors of Idun Pharmaceuticals, Inc. Dr. Mento guided Idun during its transition from a discovery focused organization to a drug development company with multiple products in or near human clinical testing. In April 2005, Idun was sold to Pfizer Inc. Previously, Dr. Mento served as President of Chiron Viagene, Inc. (subsequently Chiron Technologies, Center for Gene Therapy), and Vice President of Chiron Corporation from 1995 to 1997. Dr. Mento was Vice President of R&D at Viagene from 1992 to 1995. Prior to Viagene, Dr. Mento held various positions at American Cyanamid Company from 1982 to 1992. His last position was Director of Viral Vaccine Research and Development at Lederle-Praxis Biologicals, a business unit of American Cyanamid. Dr. Mento currently serves on the boards of directors of BIOCOM, the Biotechnology Industry Organization, BIO Emerging Company Section Governing Body, BIO Health Section Governing Body, Sangamo Biosciences, Inc. and various academic and charitable organizations. Dr. Mento holds a B.A. in Microbiology from Rutgers College, and an M.S. and Ph.D. both in Microbiology from Rutgers University. We believe Dr. Mento is qualified to serve on our board of directors because of his extensive knowledge of our business, as well as his over 30 years of experience in the biotechnology and pharmaceutical industries, including executive leadership in several pharmaceutical companies.

Harold Van Wart, Ph.D. has served as a member of our board of directors since March 2007. Dr. Van Wart has served as Chief Executive Officer of Cymabay Therapeutics Inc. (formerly Metabolex, Inc.) since 2003, a member of its board of directors since January 2003, and President since April 2001. He served as Chief Operating Officer from December 2002 to January 2003 and Senior Vice President, Research and Development, from October 2000 to December 2002. From 1999 to 2000, Dr. Van Wart was vice president and therapy head for arthritis and fibrotic diseases at Roche Biosciences, a division of Syntex (U.S.A.) Inc., a biopharmaceutical company. From 1992 to 1999, he was vice president and director of the institute of biochemistry and cell biology at Syntex (U.S.A.) Inc., a biopharmaceutical company acquired by an affiliate of Roche Holding Ltd in 1994. From 1978 to 1992, Dr. Van Wart served on the faculty of Florida State University. Dr. Van Wart holds a Ph.D. from Cornell University and a B.A. from SUNY Binghamton. He currently serves on the Emerging Companies and Health Section Governing Boards of BIO, as well as on its board of directors. We believe Dr. Van Wart is qualified to serve on our board of directors because of his extensive leadership experience in the biotechnology and biopharmaceutical industries.

Members of the Board of Directors Continuing in Office

Term Expiring at the

2017 Annual Meeting of Stockholders (Class I)

|

|

| ||

|

|

| ||

|

|

|

Preston S. Klassen, M.D., M.H.S. has served as a memberQuestions and Answers Regarding the Plan of our board of directors since February 2014. Dr. Klassen has served as Senior Vice President and Head of Global Development at Orexigen Therapeutics, Inc., since 2009. He advanced from 2002 to 2009 through several medical director positions at Amgen, Inc., most recently as Therapeutic Area Head for Nephrology and Executive Medical Director. His experience at Amgen included global regulatory filings, design and conduct of large clinical trials, clinical commercialization of multiple products, and active leadership in regulatory agency interactions. Dr. Klassen was a faculty member inDissolution

Why is the Division of Nephrology at Duke University Medical Center from 1997 to 2002. He received his M.D. from the University of Nebraska College of Medicine and completed his residency in Internal Medicine, fellowship in Nephrology, and M.H.S. degree at Duke University. We believe Dr. Klassen is qualified to serve on our board of directors because of his broad operational experience in relevant therapeutic areas and leadership experience in the biotechnology industry.

Shahzad Malik, M.D. has served as a member of our board of directors since February 2009. Dr. Malik is a General Partner at Advent Venture Partners, a position he has held since 1999. During his time with Advent, he has been actively involved with numerous investments in Europe and the United States in the biopharmaceutical and medical device arenas in a variety of therapeutic areas. A number of these are now publicly traded or have been acquired. Prior to joining Advent, Dr. Malik spent six years practicing medicine before joining the London office of management consultants McKinsey & Company. While there he served international clients in the Healthcare and Investment Banking sectors. Dr. Malik holds an M.A. from Oxford University and an M.D. from Cambridge University. He subsequently specialized in interventional cardiology while also pursuing research interests in heart muscle disorders both in the clinic and basic science laboratory. We believe Dr. Malik is qualified to serve on our board of directors because of his medical background and training and his extensive experience as a venture capital investor in the biopharmaceutical and medical device industries.

Term Expiring at the

2018 Annual Meeting of Stockholders (Class II)

|

|

| ||

|

|

| ||

|

|

| ||

|

|

|

Daniel L. Kisner, M.D. has served as a member of our board of directors since February 2014. He currently serves as an independent consultant in the life science industry. He was a partner at Aberdare Ventures from 2003 to 2011. Dr. Kisner served as ChairmanBoard recommending approval of the Plan of Dissolution?

The Board carefully reviewed and considered the Plan of Directors of Caliper Life Sciences from 2002 to 2008, and as President and CEO of its predecessor company, Caliper Technologies, from 1999 to 2002. He held positions of increasing responsibility at Isis Pharmaceuticals, Inc., from 1991 to 1999, most recently as President and COO. Dr. Kisner previously servedDissolution in pharmaceutical research and development executive positions at Abbott Laboratories from 1988 to 1991 and at SmithKline Beckman Laboratories from 1985 to 1988. He held a tenured faculty position in the Division of Medical Oncology at the University of Texas, San Antonio School of Medicine until 1985 after a five-year advancement through the Cancer Treatment Evaluation Programlight of the National Cancer Institute. Dr. Kisner is board certified in internal medicine and medical oncology. Dr. Kisner holds a B.A. from Rutgers University and an M.D. from Georgetown University. Dr. Kisner currently serves as a director at Lpath Pharmaceuticals, Zynerba Pharmaceuticals and Dynavax Technologies Corporation, and has extensive prior private and public company board experience, including serving as Chairmanfinancial position of the BoardCompany, including our available cash, resources and operations following and our previously announced review and pursuit of Directors at Tekmira Pharmaceuticals. We believe Dr. Kisner is qualified to serve on our board of directors because of his extensive leadership experience in the biotechnology and biopharmaceutical industries and as a venture capital investor.

Louis Lacasse has served as a member of our board of directors since February 2011. Mr. Lacasse has been President of GeneChem Management Inc. since 1997 and Managing Partner of AgeChem Financial Inc. since 2006. GeneChem and AgeChem are managing three life sciences venture capital funds which have invested in more than 40 companies in Canada, the United States and Europe. Prior to joining GeneChem, Mr. Lacasse worked at the Caisse de dépôt et de placement du Québec, where he held several positions between 1987 and 1997, including Vice-President of Sofinov, a private placement subsidiarystrategic alternatives. After due consideration of the Caisse which focused on biotechnology, information technology and industrial technology. Before joiningoptions available to the Caisse, Mr. Lacasse worked as a financial analyst with the National Bank of Canada, as Account Manager at the Bank of Montreal and as Project Manager at the Centre de Développement Technologique. He has also owned a small retail company. Mr. Lacasse currently serves on the board of directors of Alethia Biotherapeutics, Inc. He also has served on the boards of directors of BioChem Pharma Inc., Axcan Pharma Inc., Targeted Genetics Inc., Methylgene Inc. and Botaneco Corp. Mr. Lacasse holds a bachelor’s degree in finance from the Ecole des Hautes Etudes Commerciales and an M.B.A. from McGill University. We believe Mr. Lacasse is qualified to serve onCompany, our board of directors because of his extensive experience as a

board member and chairman of audit and compensation committees of numerous public companies, as well as his extensive experience as a venture capital investor in over 40 companies in the biotechnology and pharmaceuticals industries.

James Scopa has served as a member of our board of directors since March 2011. Mr. Scopa is a Managing Director in MPM Capital’s San Francisco office, having joined the firm in 2005. Previously, Mr. Scopa spent 18 years advising growth companies in biopharmaceuticals and medical devices at Deutsche Banc Alex. Brown and Thomas Weisel Partners. At Deutsche Banc Alex. Brown he served as Managing Director and Global Co-Head of Healthcare Investment Banking. At Thomas Weisel Partners he served on the Investment Committee for the Health Care venture fund as well as Co-Director of Healthcare Investment Banking. He holds an A.B. from Harvard College (Phi Beta Kappa), an M.B.A. from Harvard Business School and a J.D. from Harvard Law School. Mr. Scopa currently serves on the boards of directors of Astute Medical, Inc., Blade Therapeutics, Inc., Semma Therapeutics, Solasia Pharma K.K., and True North Therapeutics, Inc., and has previously served on the boards of Peplin, Inc. (sold to LEO Pharmaceuticals), iPierian, Inc. (sold to Bristol Myers Squibb), TriVascular, Inc. (sold to Endologix) and Nevro Corp. We believe Mr. Scopa is qualified to serve on our board of directors because of his extensive experience as a venture capital investor in the biotechnology and biopharmaceuticals industries, prior experience as an investment banker in those industries, and his service as a director for numerous companies.

Board Independence

Our board of directors has determined that allthe Dissolution is advisable and in the best interests of the Company and our stockholders. See “Proposal 1: Approval of the Dissolution Pursuant to the Plan of Dissolution — Reasons for the Proposed Dissolution.”

What does the Plan of Dissolution entail?

The Plan of Dissolution provides an outline of the steps for the Dissolution of the Company under Delaware law. The Plan of Dissolution provides that we will file the Certificate of Dissolution following the required stockholder approval; however, the decision of whether or not to proceed with the Dissolution and when to file the Certificate of Dissolution will be made by the Board in its sole discretion.

What will happen if the Plan of Dissolution is approved?

If the Plan of Dissolution is authorized, we expect to file a Certificate of Dissolution with the Secretary of State of the State of Delaware (the “Delaware Secretary of State”), complete the liquidation of our directors are independent directors withinremaining assets, satisfy our remaining obligations, and make distributions to stockholders of available liquidation proceeds, if any. We expect to close our stock transfer books and to discontinue recording transfers and issuing stock certificates on or around the meaningdate that the Certificate of Dissolution filed with the applicableDelaware Secretary of State becomes effective (the “Effective Date”). The Effective Date will be announced as soon as reasonably practicable after that time. We anticipate that we will notify the Financial Industry Regulatory Authority (“FINRA”) of our impending dissolution and request that our common stock permanently stop trading on the Nasdaq Stock Market LLC (“Nasdaq”) to the extent not previously delisted and deregistered from trading on Nasdaq.

What will stockholders receive in the liquidation?

Pursuant to the Plan of Dissolution, we intend to liquidate all of our remaining non-cash assets and, after satisfying or Nasdaq, listing standards, exceptmaking reasonable provision for Steven J. Mento, Ph.D.,the satisfaction of claims, obligations and liabilities as required by applicable law, distribute any remaining cash to our President, Chief Executive Officerstockholders. We can only estimate the amount of cash that may be available for distribution to stockholders. We estimate that the aggregate amount of cash distributions to stockholders will be in the range of $0.30 and Director.$0.41 per share of common stock, provided, however, that we may not have any available cash for distributions.

Board Leadership Structure

Our board of directors currently has seven independent directors and one employee director. Our board of directors is currently led by its chairman, David F. Hale. Our board of directors recognizes that it is important to determine an optimal board leadership structure to ensure the independent oversight of management as the company continues to grow. We separate the roles of chief executive officer and chairmanMany of the board in recognitionfactors influencing the amount of cash distributed to stockholders as a liquidation distribution cannot be currently quantified with certainty and are subject to change. Accordingly, you will not know the exact amount of any liquidating distributions you may receive as a result of the differences betweenDissolution when you vote on the two roles. The chief executive officer is responsible for settingDissolution Proposal. You may receive no distribution at all.

When will stockholders receive payment of any available liquidation proceeds?

Although we are not able to predict with certainty the strategic direction forprecise nature, amount or timing of distributions, if any, to the company in conjunctionextent we have available cash, we expect to make an initial distribution as soon as reasonably practicable following the Effective Date. We are not able to predict with certainty the boardprecise nature, amount or timing of directorsany distributions, primarily due to our inability to predict the amount that we will expend during the course of the liquidation and the day-to-day leadership and performance of the company, while the chairman of the board of directors provides guidance to the chief executive officer and presides over meetings of the full board of directors. We believe that this separation of responsibilities provides a balanced approach to managing the board of directors and overseeing the company.

The Board’s Role in Risk Oversight

Our board of directors has responsibility for the oversight of the company’s risk management processes and, either as a whole or through its committees, regularly discusses with management our major risk exposures, their potential impact on our business and the steps we take to manage them. The risk oversight process includes receiving regular reports from board committees and members of senior management to enable our board to understand the company’s risk identification, risk management and risk mitigation strategies with respect to areas of potential material risk, including operations, finance, legal, regulatory, strategic and reputational risk.

The audit committee reviews information regarding liquidity and operations, and oversees our management of financial risks. Periodically, the audit committee reviews our policies with respect to risk assessment, risk management, loss prevention and regulatory compliance. Oversight by the audit committee includes direct communication with our external auditors, and discussions with management regarding significant risk exposures and the actions management has taken to limit, monitor or control such exposures. The compensation committee is responsible for assessing whethernet value, if any, of our compensation policies or programs hasremaining non-cash assets. Subject to contingencies inherent in winding up our business, the potentialBoard additionally intends to encourage excessive risk-taking.authorize any distributions as promptly as reasonably practicable in our best interests and the best interests of stockholders. The nominatingBoard, in its discretion, will determine the nature, amount and corporate governance committee manages risks associatedtiming of all distributions. In any liquidation of the Company, the claims of secured and unsecured creditors of the Company take priority over the stockholders.

What will happen to our common stock if the Certificate of Dissolution is filed with the independenceSecretary of State of Delaware?

If the Certificate of Dissolution is filed with the Secretary of State, our common stock (if not previously delisted and deregistered) will be delisted from the Nasdaq and deregistered under the Exchange Act. From and after the effective time of the board, corporate disclosure practicesCertificate of Dissolution (the “Effective Time”), and potential conflictssubject to applicable law, each holder of interest. While each committeeshares of our common stock shall cease to have any rights in respect of that stock, except the right to receive distributions, if any, pursuant to and in accordance with the Plan of Dissolution and the Delaware General Corporation Law (“DGCL”). After the Effective Time, our stock transfer records shall be closed, and we will not record or recognize any transfer of our common stock occurring after the Effective Time, except, in our sole discretion, such transfers occurring by will, intestate succession or operation of law as to which we have received adequate written notice. Under the DGCL, no stockholder shall have any appraisal rights in connection with the Dissolution.

What is responsible for evaluating certain risksthe reporting and overseeing the management of such risks, the entire board is regularly informed through committee reports about such risks. Matters of significant strategic risk are considered by our board as a whole.

Board of Directors Meetings

During fiscal year 2015, our board of directors met seven times, including telephonic meetings. In that year, each director attended at least 75%listing status of the total numberCompany?

Based upon the determination by Nasdaq’s Listing Qualifications Department (the “Staff”) that the Company is a “public shell” as that term is defined in Nasdaq Listing Rule 5101, the Staff notified the Company on September 26, 2023 that trading in the Company’s stock would be suspended upon the opening of meetings held duringbusiness on October 5, 2023 unless the Company timely requests a hearing before a Nasdaq Hearings Panel to address the deficiencies and present a plan to regain compliance. We did not request a hearing and trading in the Company’s stock was suspended on the opening of business on October 5, 2023. On October 12, 2023 Nasdaq filed a Form 25 with the SEC to formally delist the Company’s stock. Following such director’s term of service bydelisting, our common stock currently trades in the board of directors and each committee ofU.S. on the board of directors onover-the-counter market, which such director served.is a less liquid market.

Committees ofIf the Board of Directors

We have three standing committees: the audit committee, the compensation committee and the nominating and corporate governance committee. Each of these committees has a written charterDissolution is approved by our board of directors. A copy of each charter can be found understockholders and if the “Investors—Corporate Governance” sectionBoard determines to proceed with the Dissolution, we will close our transfer books at the Effective Time. After such time, we will not record any further transfers of our website at www.conatuspharma.com.

Audit Committee

The audit committeecommon stock, except pursuant to the provisions of a deceased stockholder’s will, intestate succession, or operation of law and we will not issue any new stock certificates, other than replacement certificates. In addition, after the Effective Time, we will not issue any shares of our boardcommon stock upon exercise of directors currently consists of Dr. Malik (chairperson and audit committee financial expert) and Messrs. Hale and Lacasse. The audit committee met four times during fiscal year 2015, including telephonic meetings. Our board of directors has determined that all membersoutstanding options, warrants, or restricted stock units. As a result of the audit committee are independent directors, as defined in the Nasdaq qualification standards and by Section 10A of Securities and Exchange Act of 1934, as amended, or the Exchange Act. In addition, our board of directors has determined that Dr. Malik qualifies as an “audit committee financial expert” as that phrase is defined under the regulations promulgated by the SEC. The audit committee is governed by a written charter adopted by our board of directors. Our audit committee is responsible for overseeing our accounting and financial reporting processes and auditsclosing of our consolidated financial statements on behalftransfer books, it is anticipated that distributions, if any, made in connection with the Dissolution will likely be made pro rata to the same stockholders of record as the stockholders of record as of the Effective Time, and it is anticipated that no further transfers of record ownership of our board of directors. The specific powers and responsibilities of our audit committee include, among other things:common stock will occur after the Effective Time.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Both our external auditor and internal financial personnel meet privatelyAdditionally, whether or not the Dissolution is approved, we will have an obligation to continue to comply with the audit committee and have unrestricted access to this committee.

Compensation Committee

The compensation committee of our board of directors currently consists of Mr. Hale (chairperson), Dr. Kisner and Mr. Scopa. The compensation committee met four times during fiscal year 2015. Our board of directors has determined that all members of the compensation committee are independent directors, as defined in the Nasdaq qualification standards. The compensation committee is governed by a written charter approved by our board of directors. Our compensation committee reviews and approves policies relating to compensation and benefits of our officers and employees, corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other executive officers, evaluates the performance of these officers in light of those goals and objectives and approves the compensation of these officers based on such evaluations. Under the compensation committee’s charter, the compensation committee may retain or obtain the advice

of any compensation consultant, legal counsel, or other advisor as the compensation committee deems necessary or appropriate to carry out its responsibilities, only after taking into consideration the factors required by any applicable reporting requirements of the Exchange Act and Nasdaq rules. For compensation decisions for the year ended December 31, 2015, the compensation committee engaged Barney & Barney, a Marsh & McLennan Agency LLC company, for benchmarking information and executive compensation assessment. The compensation committee has determined, and Barney & Barney has affirmed, that Barney & Barney’s work does not present any conflicts of interest and that Barney & Barney is independent. In reaching these conclusions, the compensation committee considered the factors set forth in Exchange Act Rule 10C-1 and Nasdaq listing standards. In addition, the compensation committee reviewed the Radford Global Life Sciences Survey as part of its executive compensation assessment. The compensation committee also reviews and approves the issuance of stock options and other awards under our equity plan. The compensation committee will review and evaluate, at least annually, the performance of the compensation committee and its members, including compliance by the compensation committee with its charter.

Nominating and Corporate Governance Committee

The nominating and corporate governance committee of our board of directors currently consists of Dr. Van Wart (chairperson), Mr. Hale and Dr. Klassen. The nominating and corporate governance committee met one time during fiscal year 2015. Our board of directors has determined that all members of the nominating and corporate governance committee are independent directors, as defined in the Nasdaq qualification standards. The nominating and corporate governance committee is governed by a written charter approved by our board of directors. The nominating and corporate governance committee is responsible for assisting our board of directors in discharging the board’s responsibilities regarding the identification of qualified candidates to become board members, the selection of nominees for election as directors at our annual meetings of stockholders (or special meetings of stockholders at which directors are to be elected), and the selection of candidates to fill any vacancies on our board of directors and any committees thereof. In addition, the nominating and corporate governance committee is responsible for overseeing our corporate governance policies, reporting, and making recommendations to our board of directors concerning governance matters and oversight of the evaluation of our board of directors.

Report of the Audit Committee of the Board of Directors

The audit committee oversees the company’s financial reporting process on behalf of our board of directors. Management has the primary responsibility for the financial statements and the reporting process, including the systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed the audited financial statements in the company’s annual report with management, including a discussion of any significant changes in the selection or application of accounting principles, the reasonableness of significant judgments, the clarity of disclosures in the financial statements and the effect of any new accounting initiatives.

The audit committee reviewed with Ernst & Young LLP, which is responsible for expressing an opinion on the conformity of the company’s audited financial statements with generally accepted accounting principles, its judgments as to the quality, not just the acceptability, of the company’s accounting principles and such other matters as are required to be discussed with the audit committee under generally accepted auditing standards and the matters listed in Public Company Accounting Oversight Board Auditing Standard No. 16, Communications with Audit Committees. In addition, the audit committee has discussed with Ernst & Young LLP its independence from management and the company, has received from Ernst & Young LLP the written disclosures and the letter required by applicable requirements of the Public Company Accounting Oversight Board regarding Ernst & Young LLP’s communications with the audit committee concerning independence, and has considered the compatibility of non-audit services with the auditors’ independence.

The audit committee met with Ernst & Young LLP to discuss the overall scope of its services, the results of its audit and reviews, its evaluation of the company’s internal controls and the overall quality of the company’s financial reporting. Ernst & Young LLP, as the company’s independent registered public accounting firm, also periodically updates the audit committee about new accounting developments and their potential impact on the company’s reporting. The audit committee’s meetings with Ernst & Young LLP were held with and without management present. The audit committee is not employed by the company, nor does it provide any expert assurance or professional certification regarding the company’s financial statements. The audit committee relies, without independent verification, on the accuracy and integrity of the information provided, and representations made, by management and the company’s independent registered public accounting firm.

In reliance on the reviews and discussions referred to above, the audit committee has recommended to the company’s board of directors that the audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2015. The audit committee and the company’s board of directors also have recommended, subject to stockholder approval, the ratification of the appointment of Ernst & Young LLP as the company’s independent registered public accounting firm for 2016.

This report of the audit committee is not “soliciting material,” shall not be deemed “filed” with the SEC and shall not be incorporated by reference by any general statement incorporating by reference this proxy statement into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended whether(the “Exchange Act”) until we have exited such reporting requirements. We did not request a hearing before the Nasdaq Hearings Panel with respect to the delisting of our common stock on Nasdaq and plan to initiate steps to exit from certain reporting requirements under the Exchange Act.

However, such process may be protracted and we may be required to continue to file Current Reports on Form 8-K to disclose material events, including those related to the Dissolution. Accordingly, we will continue to incur expenses that will reduce the amount available for distribution, including expenses of complying with public company reporting requirements and paying its service providers, among others.

Can I still sell my shares?

Yes, for a limited period of time. However, the Board may direct that our stock transfer books be closed and recording of transfers of common stock discontinued as of the earliest of:

Further, we expect that the Board will close our stock transfer books on or around the Effective Date (such actual time, the “Final Record Date”). Following the Final Record Date, certificates representing shares of our common stock will not be assignable or transferable on our books except by will, intestate succession or operation of law, and we will not issue any new stock certificates.

Do I have appraisal rights?

No. Under the DGCL, stockholders are not entitled to assert appraisal rights with respect to the Plan of Dissolution. Neither our Amended and Restated Certificate of Incorporation nor our Amended and Restated Bylaws provides for appraisal or other similar rights for dissenting stockholders in connection with the Dissolution, and we do not intend to independently provide stockholders with any such right.

Are there any risks related to the Dissolution?

Yes. You should carefully review the section entitled “Risk Factors” beginning on page 11 of this proxy statement for a description of risks related to the Dissolution.

Will I owe any U.S. federal income taxes as a result of the Dissolution?

If the Dissolution is approved and implemented, a stockholder that is a U.S. person generally will recognize gain or loss on a share-by-share basis equal to the difference between (1) the sum of the amount of cash and the fair market value of property, if any, distributed to the stockholder with respect to each share, less any known liabilities assumed by the stockholder or to which the distributed property (if any) is subject, and (2) the stockholder’s adjusted tax basis in each share of our common stock. You are urged to read the section entitled “Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution —Certain Material U.S. Federal Income Tax Consequences” beginning on page 31 of this proxy statement for a summary of certain material U.S. federal income tax consequences of the Dissolution, including the ownership of an interest in a liquidating trust, if any.

CAUTIONARY NOTE REGARDING FORWARD LOOKING-STATEMENTS

This Proxy Statement, including Annex A attached hereto, contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These forward-looking statements are based on current expectations and beliefs and involve numerous known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These forward-looking statements should not be relied upon as predictions of future events as it cannot be assured that the events or circumstances reflected in these statements will be achieved or will occur. In some cases, forward-looking statements can be identified by the use of terminology such as “anticipates,” “believes,” “continue,” “estimates,” “expects,” “intends,” “may,” “opportunity,” “plans,” “potential,” “predicts,” “targets,” “will” or the negative thereof or other comparable terminology. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. For example, forward-looking statements include, but are not limited to statements regarding:

The forward-looking statements in this Proxy Statement are only predictions. Although we believe that the expectations presented in the forward-looking statements contained herein are reasonable at the time of filing, there can be no assurance that such expectations or any of the forward-looking statements will prove to be correct. These forward-looking statements, including with respect to the timing and success of the Dissolution pursuant to the Plan of Dissolution, are subject to inherent risks and uncertainties, including, among other things:

Further information regarding the risks, uncertainties and other factors that could cause actual results to differ from the results in these forward-looking are discussed under the section entitled “Risk Factors” set forth below, and for the reasons described elsewhere in this Proxy Statement. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in our periodic reports and documents filed with the SEC. See the section titled “Where You Can Find More Information” in this Proxy Statement. There can be no assurance that the Dissolution will be completed pursuant to the Plan of Dissolution, or if it is completed, that it will close within the anticipated time period or that the expected benefits of the Dissolution will be realized.

If any of these risks or uncertainties materializes or any of these assumptions proves incorrect, our results following completion of the Dissolution could differ materially from the forward-looking statements. All forward-looking statements and reasons why results may differ included in this Proxy Statement are made as of the date hereof. New risk factors and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties. We do not undertake any obligation (and expressly disclaim any such obligation) to publicly update any forward-looking statement to reflect events or circumstances after the date hereofon which any statement is made or to reflect the occurrence of unanticipated events, except as required by applicable law.

In addition, statements that “we believe” and irrespectivesimilar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of any general incorporation language in anythe date of this Proxy Statement, and while we believe such filing, exceptinformation forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements:

RISK FACTORS

In addition to the extentother information included and incorporated by reference into this Proxy Statement, including the matters addressed in the section entitled “Cautionary Statement Regarding Forward-Looking Statements,” you should carefully consider the following risks before deciding whether to vote for the approval of the Dissolution Proposal and the Adjournment Proposal, as well as the risks described in our Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2023, which is filed with the SEC and incorporated by reference into this Proxy Statement. You should also read and consider the other information in this Proxy Statement and the other documents incorporated by reference into this Proxy Statement. See the section entitled “Where You Can Find More Information,” beginning on page 36 of this Proxy Statement. Any of these risks, as well as other risks and uncertainties, could materially and adversely affect our business, results of operations and financial condition, which in turn could materially and adversely affect the trading price of shares of our common stock. Stockholders should keep in mind that the risks below are not the only risks that are relevant to your voting decision. Additional risks not currently known or currently material to us may also harm our business.

Risks Related to the Dissolution

We cannot assure you as to the amount of distributions, if any, to be made to our stockholders.

If our stockholders approve the Dissolution, we estimate that we specifically incorporate this information by reference,will have between approximately $1.29 to $1.76 million of cash that we will be able to distribute to our stockholders in connection with the Dissolution, which implies a per share distribution of between $0.30 and shall not otherwise$0.41 based on 4,271,759 assumed shares outstanding as of October 16, 2023. This amount may be deemed filed under such acts.

The foregoing report has been furnished by the audit committee.

Respectfully submitted,

The Audit Committee of the Board of DirectorsShahzad Malik, M.D. (chairperson)

David F. Hale

Louis Lacasse

Compensation Committee Interlocks and Insider Participation

Mr. Hale (chairperson), Dr. Kisner and Mr. Scopa served as members of our compensation committee during fiscal year 2015. None of the members of our compensation committee during fiscal year 2015 has ever been one of our officers or employees. None of our executive officers currently serves, or has served, as a member of the board of directors or compensation committee of any entity that hadpaid in one or more executive officers servingdistributions. We cannot predict the timing or amount of any such distributions, as a memberuncertainties exist as to the value we may receive upon the sale of all or substantially all of our boardassets, the net value of directorsany remaining assets after such sales are completed, the ultimate amount of our liabilities, the operating costs and amounts to be set aside for claims, obligations and provisions during the liquidation and winding-up process, and the related timing to complete such transactions. These and other factors make it impossible to predict with certainty the actual net cash amount that will ultimately be available for distribution to stockholders or compensation committee during fiscal year 2015.the timing of any such distributions. In addition, as discussed below under the heading “Risks Related to the Dissolution—The amount of cash available to distribute to our stockholders depends on our ability to dispose of certain of our non-cash assets,” there are many factors impacting our ability to successfully execute the sale or disposition of certain of our non-cash assets. As a result of these and other risks and uncertainties, we have provided a wide range of cash that we estimate may be available to distribute to our stockholders in connection with the Dissolution.

Director Nomination Process

Director Qualifications

In evaluating director nomineesWithout limiting its flexibility, our Board may, at its option, rely on the nominating“safe harbor” procedures under Sections 280 and corporate governance committee will consider281(a) of the DGCL to, among other things, obtain an order from the following factors:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The nominating and corporate governance committee’s goal is to assemble a board of directors that brings to the company a varietyamount and form of perspectivessecurity reasonably likely to be sufficient to provide compensation for all known, contingent and skills derived from high quality business and professional experience. Moreover, the nominating and corporate governance committee believespotential future claims against us. There can be no assurances that the background and qualificationsDelaware Court of Chancery would not require us to withhold additional amounts in excess of the boardamounts that we believe are sufficient to satisfy our potential claims and liabilities. Accordingly, stockholders may not receive any distributions of directors,our remaining assets for a substantial period of time.

In addition, there are numerous factors that could impact the amount of the reserves to be determined by any such Court Order, and consequently the amount of cash initially available for distribution, if any, to our stockholders following the effective time of the Dissolution, including without limitation:

Further, the amount of any distributable proceeds and our ability to make distributions to our stockholders depends on our ability to sell or otherwise dispose of our remaining non-cash assets in order to attain the highest value for such non-cash assets and maximize value for our stockholders and creditors, which is subject to significant risks and uncertainties.

In addition, as we wind down, we will continue to incur expenses from operations, such as operating costs, salaries, rental payments, directors’ and officers’ insurance, payroll and local taxes; and other legal, accounting and financial advisory fees, which will reduce any amounts available for distribution to our stockholders.

As a result of these and other factors, we cannot assure you as to any amounts to be distributed to our stockholders if our Board proceeds with the Dissolution. If our stockholders do not approve the Dissolution Proposal, no liquidating distributions will be made. See the section entitled “Estimated Liquidating Distributions” beginning on page 20 of this Proxy Statement for a description of the assumptions underlying and sensitivities of our estimate of the total cash distributions to our stockholders in the Dissolution.

Liquidating distributions to stockholders could be substantially reduced and/or delayed due to uncertainty regarding the resolution of certain potential tax claims, litigation matters and other unresolved contingent liabilities of the Company.

Without limiting its flexibility, our Board may, at its option, rely on the “safe harbor” procedures under Sections 280 and 281(a) of the DGCL to, among other things, obtain the Court Order establishing the amount and form of security for pending claims for which the Company is a party, contingent or unmatured contract claims for which the holder declined the Company’s offer of a security, and unknown claims that, based on facts known to the Company, are likely to arise or become known within five years filing of the Certificate of Dissolution (or such longer period of time, not to exceed ten years, as the Delaware Court of Chancery may determine), and pay or make reasonable provision for our uncontested known claims and expenses and establish reserves for other claims as required by the Court Order and the DGCL.

Whether any remaining assets or cash of the Company can be used to make liquidating distributions to stockholders would depend on whether claims for which we have set aside reserves are resolved or satisfied at amounts less than such reserves and whether a need has arisen to establish additional reserves. We cannot assure stockholders that our liabilities can be resolved for less than the amounts we have reserved, or that unknown liabilities that have not been accounted for will not arise. As a result, we may continue to hold back funds and delay additional liquidating distributions to stockholders. It is important for us to retain sufficient funds to pay the expenses and liabilities actually owed to our creditors, because under the DGCL, if the we fail to do so, each stockholder could be held liable for the repayment to creditors, out of the amounts previously distributed to such stockholder in the Dissolution from us or from any liquidating trust or trusts, of such stockholder’s pro rata share of such excess (up to the full amount actually received by such stockholder in Dissolution).

consideredWe cannot predict the timing of the distributions to stockholders.

Following the sale or other disposition of our remaining non-cash assets, or such earlier time as our Board determines in its sole discretion, we will file the Certificate of Dissolution as soon as practicable and in accordance with the DGCL.

We are currently targeting, if approved by our stockholders, a group, should provide a significant mixfiling of experience, knowledge and abilities thatthe Certificate of Dissolution as soon as practical following the Special Meeting. Ultimately, the decision of whether or not to proceed with the Dissolution will allowbe made by our Board in its sole discretion. If our stockholders approve the boardPlan of directors to fulfill its responsibilities. Nominees are not discriminated against on the basis of race, religion, national origin, sexual orientation, disability or any other basis proscribed by law.